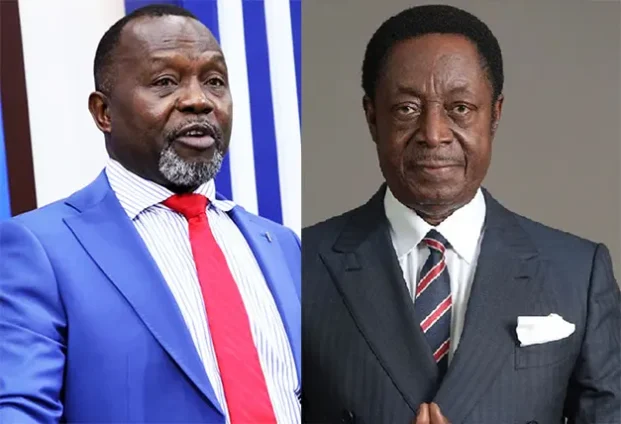

Attorney‑General and Minister for Justice, Dr. Dominic Akuritinga Ayine, has clarified why criminal charges previously filed against former Finance Minister Dr. Kwabena Duffour and other directors of the now-defunct Unibank Ghana Limited were discontinued. According to Dr. Ayine, investigations revealed no evidence of theft, fraud, or personal enrichment by the accused.

Speaking during an interview on Starr Chat with broadcaster Bola Ray, Dr. Ayine emphasized that public debates around the Unibank collapse had often been influenced by the prominence of the Duffour family rather than by factual legal evidence.

When reviewing cases arising from Ghana’s financial sector clean-up, Dr. Ayine noted that Unibank’s circumstances were different from other banks where criminal charges were successfully pursued. He contrasted this with the Capital Bank case, where investigators had traced liquidity support from the Bank of Ghana being misappropriated for private use, even providing detailed geographic tracking of the diverted funds.

“That is pure stealing,” Dr. Ayine said, explaining why Capital Bank directors faced criminal prosecution.

In contrast, Unibank’s failure involved risk-taking through standard banking channels, which, while unfortunate, does not constitute a crime under Ghanaian law. He stressed that loan defaults or business failures are not criminal offenses unless accompanied by dishonesty or fraud.

Responding to claims that Unibank’s owners looted depositors’ funds, Dr. Ayine was firm:

“There was no evidence that the Duffours stole money.”

He also clarified that alleged breaches of trust or loans to affiliated companies, while potentially governance or regulatory concerns, do not automatically amount to criminal conduct. Criminal liability requires clear proof of dishonesty, diversion of funds, or personal enrichment.

Ultimately, these legal realities guided the state’s decision to withdraw criminal charges against Dr. Duffour and other directors, though civil actions and asset recovery proceedings remain ongoing.

Dr. Ayine concluded by underscoring the distinction between poor business judgment and criminal wrongdoing, reminding the public that bank failure alone does not equal criminality. He continues to defend this position despite criticism, highlighting the importance of fairness and evidence-based prosecution.

The Unibank case now serves as a key lesson in financial sector oversight, accountability, and the limits of criminal law in dealing with business failures—balancing public scrutiny with legal realities.